Relevant

How important is Walmex to Walmart Inc.?

Walmart Inc. closed the end of January with more than 92 million square meters in total floor space, 27% of which would be operating outside of the United States.

To give a sense of just how massive this figure is, the city of Paris would barely be able to fit the 10 thousand Walmart stores operating across the world within its territory.

Despite accounting for more than 30% of total stores, Walmart Mexico represented only just 7% of total floor space at the end of 2024 — as average store sizes in the Latin American country were considerably smaller to those in the United States and other markets.

For example, an average Supercenter in the United States would have an area of 16.5 thousand square meters, a figure 125% higher than a Supercenter in Mexico.

Interestingly, total floorspace in Mexico has grown by more than 10% during the last 5 years. Contrasting heavily with the contractions seen in the U.S. (-0.7%) and the rest of the company’s international footprint (-28%) during the same period.

It’s important to note that the international contraction was also largely affected by the divestment of the company’s operations in the United Kingdom and Japan in 2021.

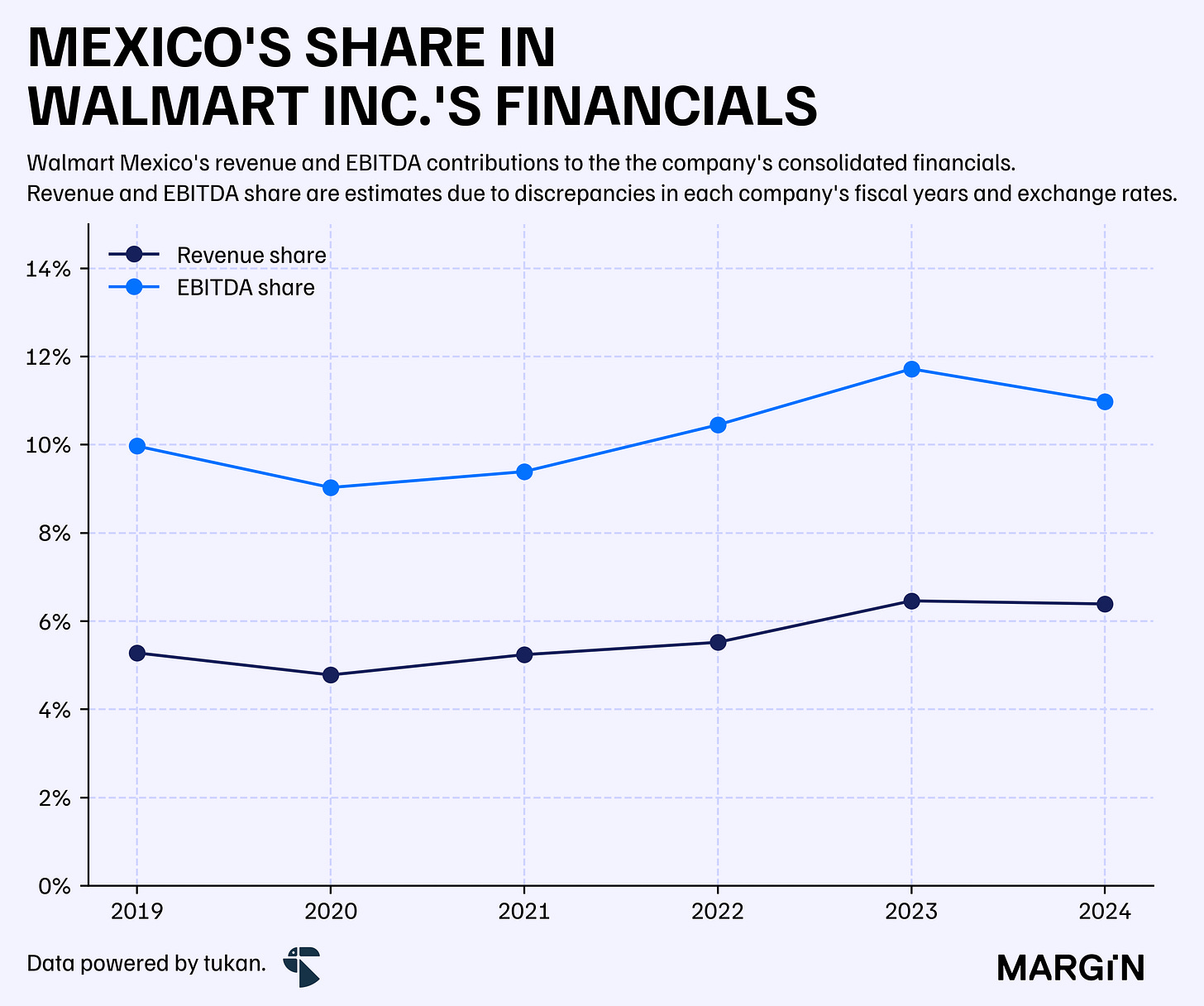

Based on our estimates from company filings, Walmart Mexico accounts for a relatively small share of the holding’s total revenues — 6.4%, as of the latest fiscal year.

Whenever we refer to Walmart Mexico, we are excluding Central American operations — unless explicitly stated otherwise.

However, Mexico’s share across Walmart Inc’s. EBITDA came in considerably higher, at 11% — and has been consistently gaining further relevance in recent years, in part, benefitted by the Mexican peso’s appreciation against the U.S. dollar.

According to the company’s latest 10-K, the U.S. retail operation had an EBITDA margin of 6.8% — a ratio 393 basis points lower than it’s Mexican subsidiary (10.7%).

For an industry that operates under such tight margins, that’s a massive difference in efficiency and profitability.

These benefits to the company’s bottom-line have led the holding to make some heavy investments south of the border. For example, in the past 2 years CAPEX in retail operations as a percentage of total sales has been close to 2.89% for the Mexican & Central American subsidiary — whereas other international operations have received investments equivalent to 2.32% of those region’s total revenues; with U.S. retail operations receiving 2.62% of total revenues.