Roaming

What's happened with AT&T Mexico since the Iusacell acquisition?

In early 2015, AT&T finalized the acquisition of Iusacell from Grupo Salinas for over USD $2.5 billion. Through this acquisition, the U.S. telecom giant incorporated all of Iusacell’s network assets, licenses, and its 9.2 million subscribers—a figure that, at the time, accounted for approximately 8% of the total share of mobile contracts in Mexico.

In a press release, former AT&T CEO Randall Stephenson emphasized the acquisition’s strategic significance:

“We look forward to bringing more wireless competition to Mexico along with an improved mobile Internet experience for customers. Expanding and enhancing Iusacell’s mobile network to cover millions of additional consumers and businesses is our top priority.”

Just four months later, AT&T announced the acquisition of Nextel for USD $1.9 billion. The merger of Iusacell and Nextel marked a clear move to aggressively compete with América Móvil for leadership in Mexico’s wireless market.

So, what’s happened to AT&T’s business in Mexico since the acquisition?

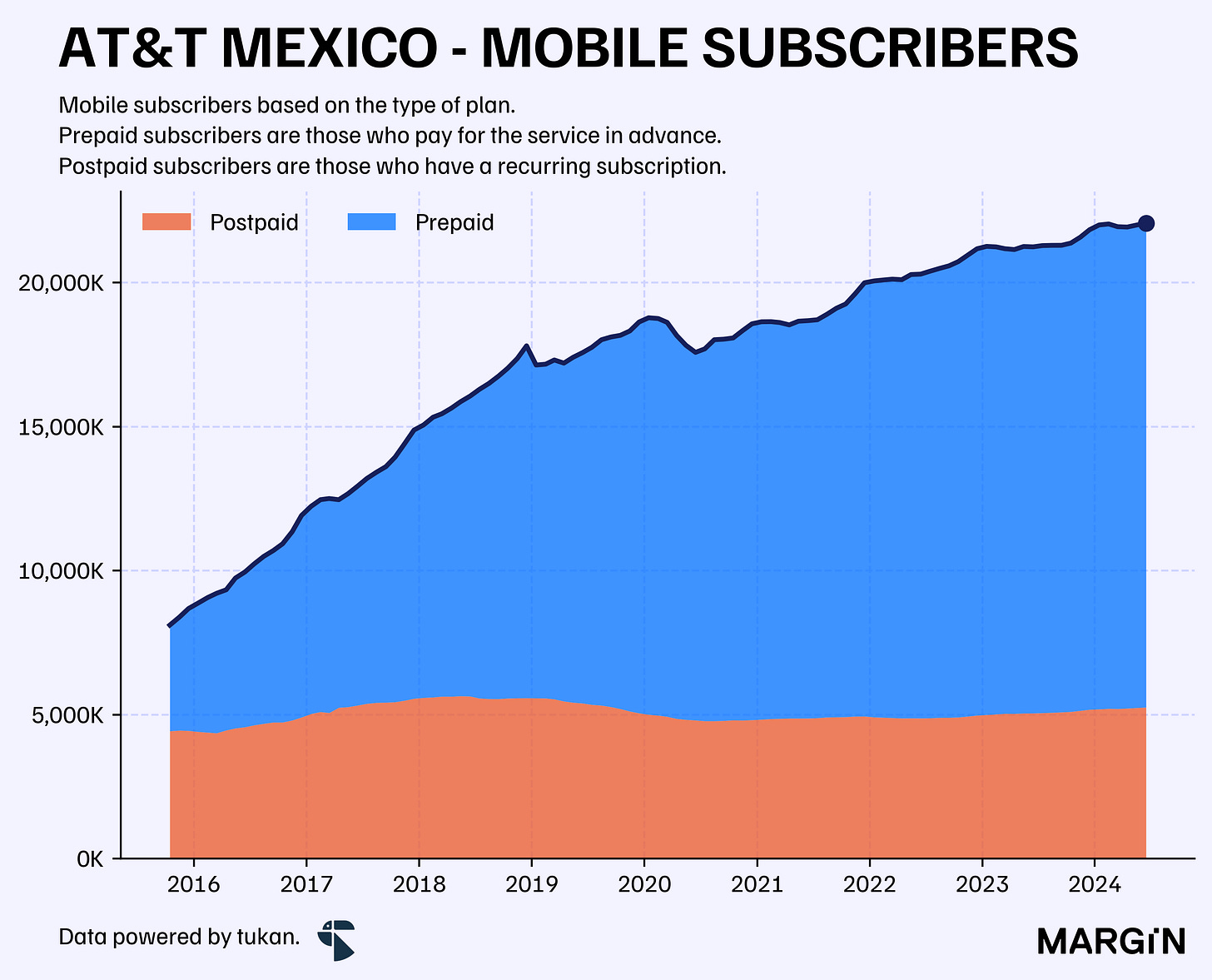

According to data from the Mexican regulator (IFT), AT&T’s subscriber base has grown at a compound annual growth rate (CAGR) of 12% since their entrance into the Latin American market. This growth has increased the total number of customers from 8 million at the end of October 2015 to over 22 million as of the second quarter of 2024.

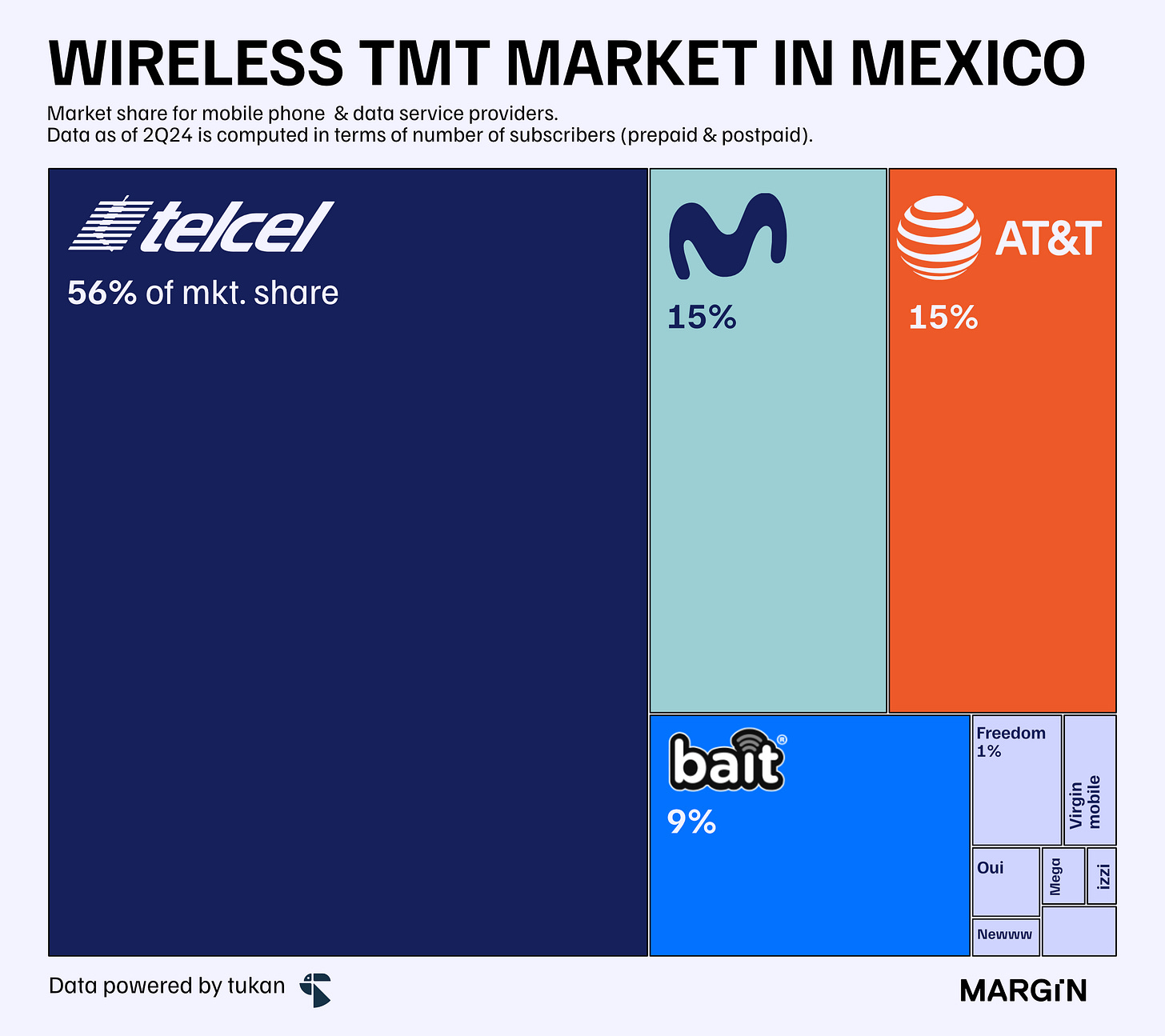

Since 2015, AT&T’s market share in Mexico reached a peak of 16.2% in September 2023 but has since declined to 14.8%. This decrease is primarily attributed to intensified competition from well-funded mobile virtual network operators (MVNOs) such as Bait (Walmart), izzi Móvil (Televisa), Oui (Grupo Salinas), and Mega Móvil (Megacable).

As shown in the chart below, postpaid customers for the American telecom giant have remained relatively stable since the brand’s inception in late 2015. In contrast, prepaid customers have driven most of the company's growth.

In the wireless industry, postpaid customers are generally considered more valuable due to their higher average revenue per user (ARPU), lower churn rates, and greater lifetime value.

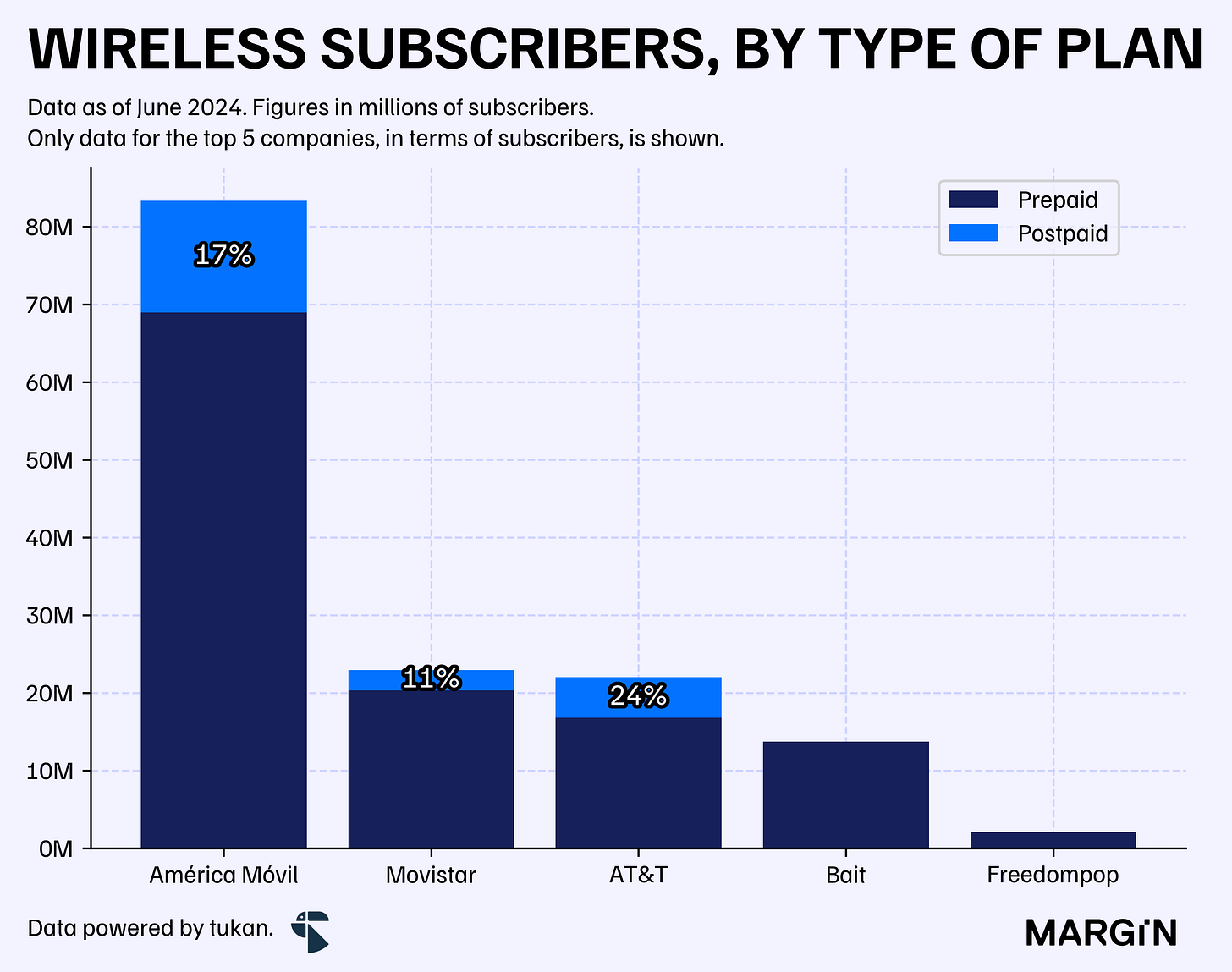

In the Mexican market, the mobile space has traditionally been dominated by prepaid customers. As of the second quarter of 2024, 84% of all mobile lines in the country were prepaid — a proportion that has remained virtually unchanged since 2013.

Regulatory data shows that among the five companies with more than 1% market share in Mexico, AT&T has the highest exposure to postpaid subscribers. As of June 2024, postpaid clients accounted for approximately 23% of AT&T’s portfolio.

This ratio was of 55% when they took over in 2015.

On the other hand, MVNOs like Megacable and izzi operate almost entirely on postpaid plans. However, their market presence is still quite limited, representing just 0.3% and 0.2% of total subscribers in the country, respectively.

In theory, this would imply that AT&T would have higher than average ARPUs (average revenue per user), and lower churn rates than the competition.

However, company filings from the three largest players in the space point towards a different trend.