High Margins

Uncovering the most profitable service industries in Mexico.

According to the latest census from INEGI, non-financial service-related companies in Mexico generated an operating profit1 of over MXN $1.3 trillion during 2018, implying an operating margin of approximately 32% for businesses within this sector.

The non-financial service industry in Mexico constitutes over 36% of the country's GDP and employs more than ~40% of the total workforce, underscoring its significance in the nation’s economic model.

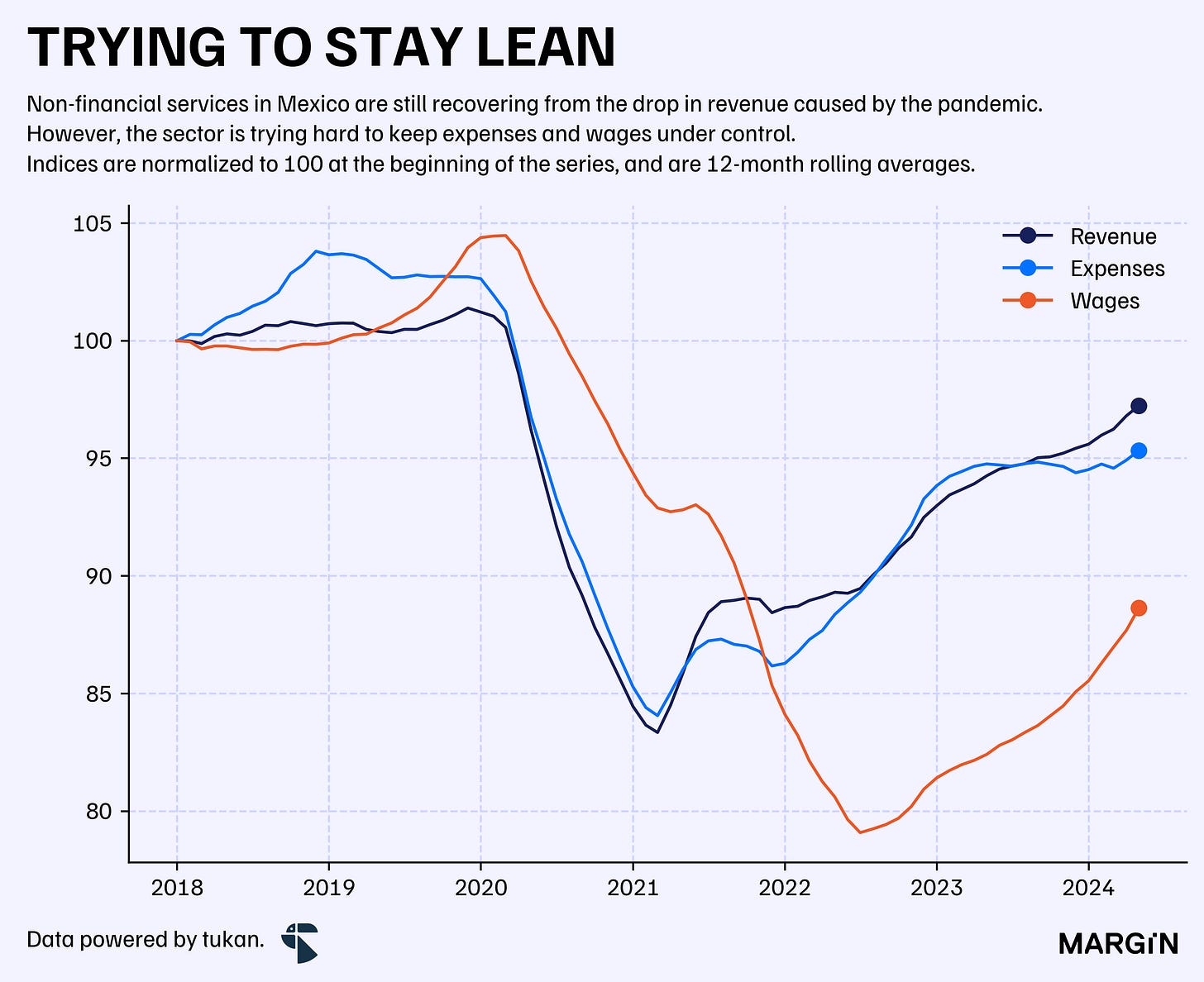

However, most service-related industries have experienced contractions in their overall income when compared to 2018. Out of the 58 industries tracked by INEGI on a monthly basis, only half have recovered to their pre-pandemic levels.

Note that INEGI presents all indices adjusted by inflation, so the growth figures presented in this article are all expressed in “real terms”.

This situation has forced Mexican service businesses to significantly reduce total costs — and in particular — wages to its employees. As of 2024, total wages and operating expenditures are down 15% and 8% from their peaks in 2020 and 2018, respectively, dropping below income levels and thereby improving overall operating margins for companies.

In today’s article, we take a dive into the census database and extrapolate our findings with recent economic surveys to uncover which service industries are becoming the most efficient and high-margin in the country.

Based on INEGI data, we estimate that operating margins improved by approximately 380 basis points over the past six years and could see further upticks in efficiency as economic activity within the industry continues to recover from the shock caused by the pandemic.

At an aggregate level, we identify TMT, gambling and computer services design (software) as some of the industries with the highest overall margin expansion within the country. In the following chart, we present 2018 vs 2024 operating margins for each of the 58 industries tracked by the Mexican Statistical Institute.