Monday, On the Margin

Investment; business confidence; equities; banks & SOFIPOs; airport operators; consumption & consumer confidence; trade; remittances and inflation.

Investment

Investment in fixed assets decreased slightly (0.3%) in November, according to seasonally adjusted figures reported by INEGI. This marks the third consecutive month of negative annual rates for this indicator.

This index measures how much businesses and the government invest in long-term assets like buildings and machinery. Think of it like CapEx but for the whole economy.

For the private sector only, investment in construction fell by 2.5%; offset slightly by the 5.5% YoY growth in machinery and equipment.

Business confidence

Business confidence continued to deteriorate at the start of 2025, as INEGI’s index fell by 4.6% YoY in January1. Although this indicator remains above the 50-point threshold—indicating “optimism” among business leaders—it has now recorded nine consecutive periods of annual declines.

Notably, executives in the services and construction sectors experienced a greater loss of confidence than the market as a whole.

As expected, there has been a perceived worsening of the business climate in the country since mid-last year. More than half of the specialists surveyed by Banxico have considered that businesses have been facing a challenging environment for investment since July 2024, amid the implementation of the controversial judicial reform and increased uncertainty regarding trade relations with the United States.

Equities

At the same time, confidence from foreign investors in the Mexican stock market remains low. By the end of December 2024, foreign investors’ balance of equity holdings stood at $131.6 billion dollars, marking a 30% YoY decline. Aside from March and April 2020, this was the largest annual drop in foreign holdings since 2010.

As can be seen in the chart below, the “capital flight” from foreign investors has been progressively worsening since the start of the pandemic.

Banks & SOFIPOs

Mexican banks closed 2024 with more than $15.2 trillion pesos in assets (up 14.0% YoY). Profits for the whole commercial banking system surpassed $288 billion pesos, implying a return over assets (ROA) of 2.0% — down 10 basis points versus the previous year.

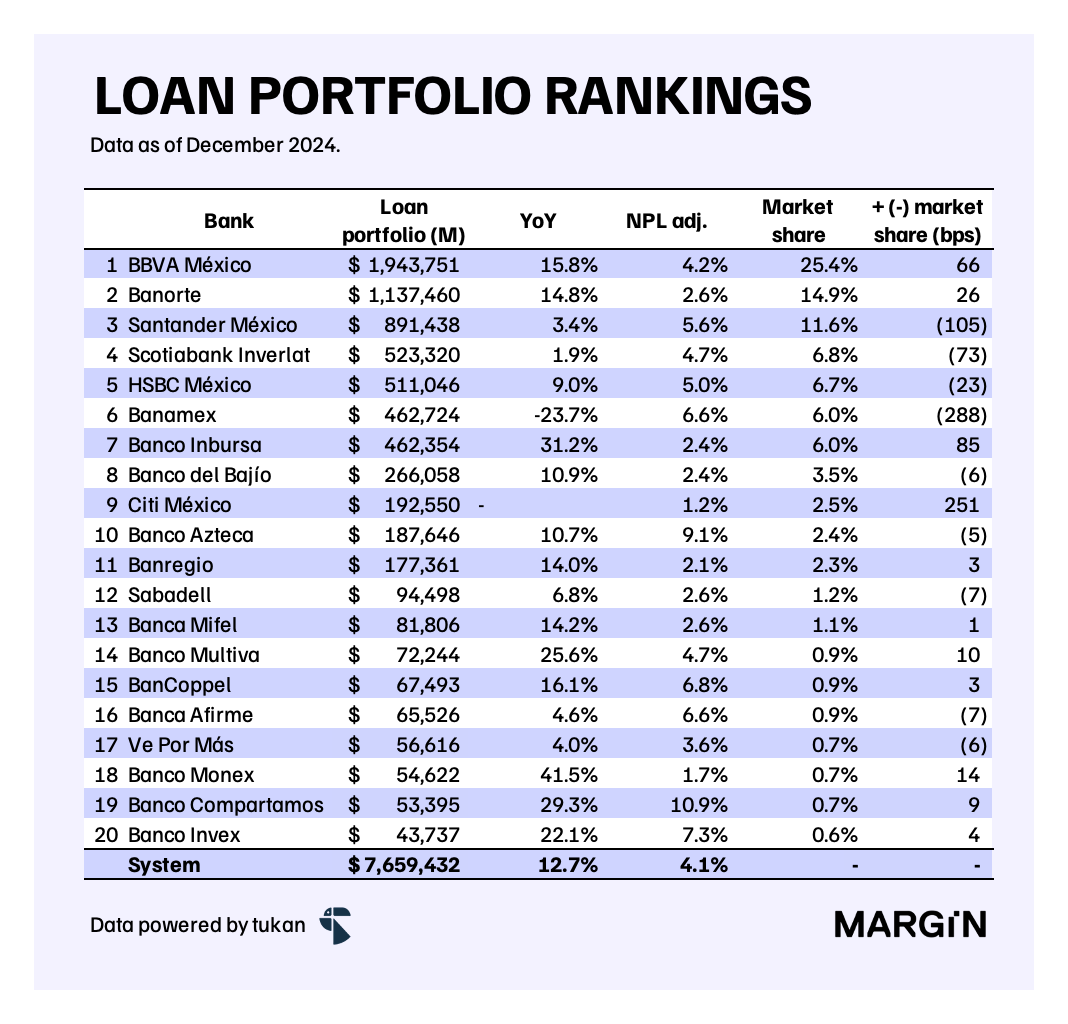

At the same time, loan portfolios reached $7.6 trillion pesos — up 12.7% YoY, with both commercial and consumer loans posting double digit growth rates during the year.

We also got the “official” outcome of Banamex and Citi’s separation process. According to CNBV data, Citi México retained $192 billion pesos from Citibanamex commercial loan portfolio — a figure equivalent to 55% of both companies’ commercial loan books.

This $192 billion pesos were made up by 76% in loans to corporates, 18% to financial institutions and 6% to government entities.

Mexican fintechs operating as SOFIPOs closed 2024 with high quarterly growth rates in their loan portfolios. As of December, the resources managed by these 7 companies reached $43 billion pesos.

Notably, Nu’s loan portfolio surpassed $19 billion pesos, growing 16% during the quarter. For reference, Consubanco’s and Bancoppel’s consumer loan portfolio were of $18 billion and $23 billion pesos at the end of last year.

Airports

Air passenger traffic across Mexico’s publicly listed airport groups (OMA, ASUR and GAP) rose by 3% YoY in January 2025, adding over 361,000 passengers.

Considering only Mexican operations, OMA saw the highest growth at 10%, primarily boosted by increased traffic at Monterrey airport (+16% YoY). GAP followed with a 6% increase, driven by a 10% growth rate in the Guadalajara airport. In contrast, ASUR faced a 4% decline due to a 6% drop in passenger traffic at Cancun airport.

Consumption

On the consumption side, there was greater resilience towards the end of 2024. Following monthly declines of up to 0.7% in September and October, consumption in the country rebounded by 0.5% in November, according to seasonally adjusted figures.

On an annual basis, consumption growth has been relatively modest, reporting a YoY increase of 0.7%, primarily driven by +1.6% growth in the demand for imported goods.

From March 2023 to May 2024, the consumption of imported goods in Mexico consistently maintained double-digit annual growth rates.

However, Mexican households have begun to lose confidence. January 2025 saw the first annual decline in consumer confidence indicator since early 2023, dropping by 0.9%.

Interestingly, the “intent to purchase” indices for household appliances and vehicles remain near record highs, with both indicators rising by about 2% YoY, according to seasonally adjusted figures.

Trade

Trade between Mexico and the United States continued to grow in 2024, reaching $839.9 billion dollars, a 5.3% increase from 2023. This showcases Mexico’s position as the U.S.’s top trading partner, with total trade flows 10% higher than Canada and 44% greater than China.2

Notably, Mexico has become the largest supplier of U.S. imports, contributing nearly 16% in 2024. Over the past decade, Mexico’s share increased by 3 percentage points, while Canada’s share decreased by 2 points and China’s by more than 6 points.

Remittances

Total remittances for 2024 amounted to $64.7 billion dollars, just 2.3% higher than in 2023. Notably, four out of every ten dollars came from just two U.S. states: California and Texas.

Inflation

For the first month of 2025 the annual inflation rate stood at 3.6%, dropping below 4% for the first time in almost 4 years.

The price deceleration over the past year was primarily driven by non-core inflation, which posted an annual rate of 3.3%. Meanwhile, core inflation—which tracks non-volatile goods and services—remained relatively stable at an annual rate of 3.7%.

Banxico’s board of governors also opted for decreasing the country’s benchmark rate to 9.5% (a 50 bps cut) — the decision was 4 to 1 and the central bank suggested that we could expect further cuts along the year if inflation numbers allow it.

Based on seasonally adjusted figures.

Imports and exports.