Monday, On the Margin

Business confidence; trade; heavy vehicle registrations; consumption; inflation; productivity and investment.

Unsettling

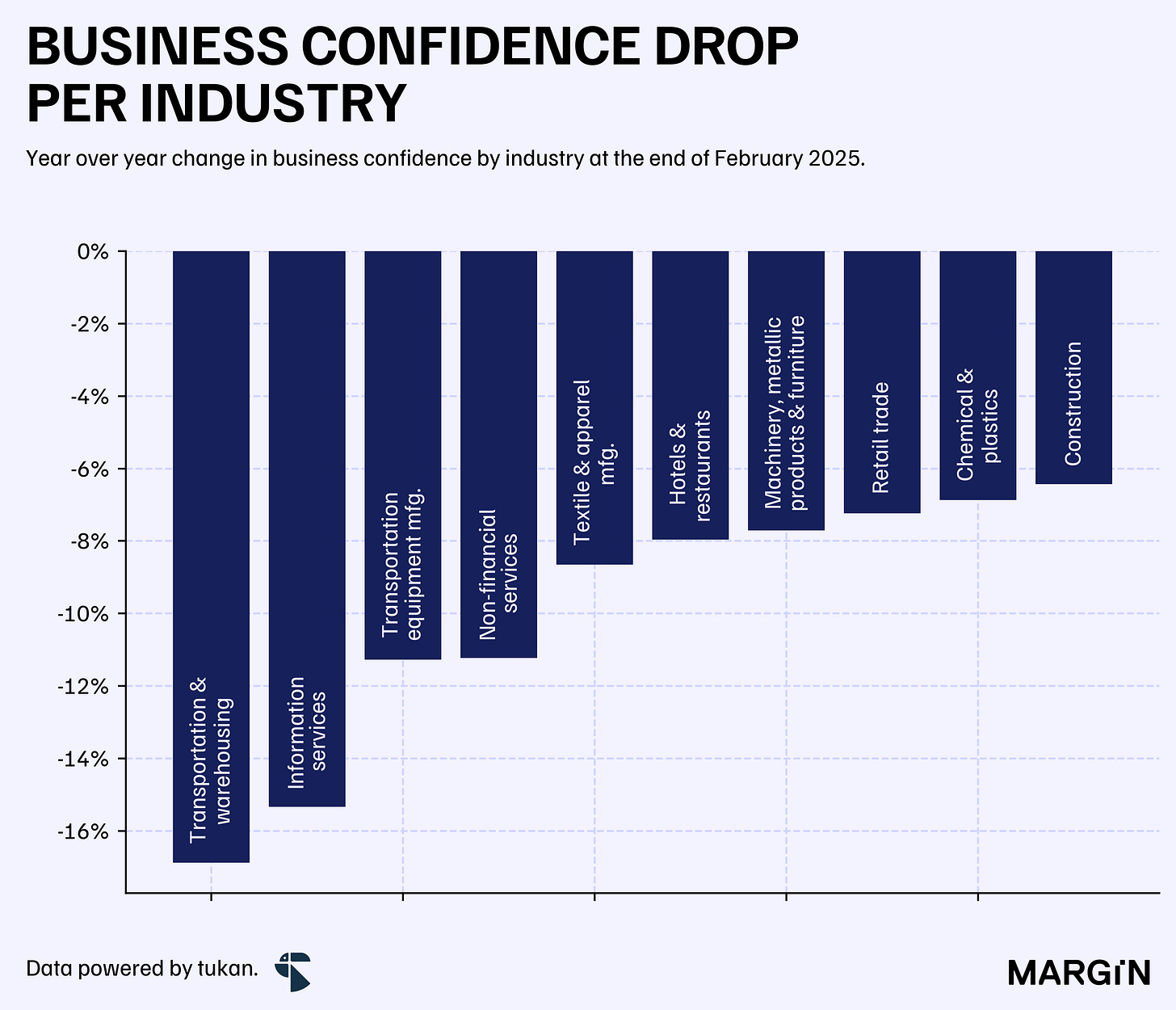

Last week, we began to see the statistical impact of Trump’s on-and-off tariffs on the Mexican economy, as confidence among the country’s business leaders dropped by more than 8% year-over-year in February.

Companies operating in transportation and warehousing services, information services, and transportation and equipment manufacturing suffered — by far — the largest contractions during the month.

Tariffs or no tariffs, we believe that much of the damage has already been done, as Trump’s indecision and unpredictable swings have likely stalled many long-term investment projects in the country.

These effects are already visible in the investment appetite index measured by INEGI, where nearshoring industries, in particular, have shown significant drops since the start of the year.

This was further reflected in the country’s fixed asset investment figures published last week, which showed a 4% decline in total investment, according to seasonally adjusted figures.

According to INEGI, December’s drop represents the 4th consecutive decline in investment figures for the country since September and paints a bleak picture considering that prior to these declines we had 42 consecutive months of growth rates for this indicator.

This index measures how much businesses and the government invest in long-term assets like buildings and machinery. Think of it like CapEx but for the whole economy.

Heavy vehicles

Motor heavy vehicle registrations for companies with cargo, lease, and parcel and courier permits came in at 2,010 units during January, contracting 8%YoY and 13% below December’s figures.

According to regulatory data, only 67 companies registered more than 5 vehicles during the month — the lowest since April 2023.

Trade

Ironically, the U.S. published an update on its trade data on Thursday, where data from the U.S. Census showed an 8% annual increase in total trade flow for Mexico and the United States — amounting to almost $70 billion USD in total trade flow.

Despite current tensions, total trade with other major partners such as China and Germany also grew at mid-single digit rates YoY.

Swiss imports to the U.S. jumped sharply during December and continued the trend during January as traders tried to bring gold and other precious metals into the United States ahead of potential tariffs.

Consumption

Internal consumption also closed 2024 with a grayish note, as Mexico’s consumption index dropped by 0.8% YoY at the end of December, based on seasonally adjusted figures, following 45 periods of positive annual rates since March 2021.

The decline was driven by a 5.1% contraction in the consumption of imported goods and a 1.9% decrease in domestic goods.

From early 2023 to mid-2024, the consumption of imported goods in Mexico consistently maintained double-digit annual growth rates.

Inflation

Inflation remained controlled in February. The CPI increased by only 0.28% month-over-month, driven by rises in services, where prices rose 0.55% month-over-month (MoM). Meanwhile, the non-core component decreased by 0.39% MoM.

Annually, the inflation rate was 3.77% in February, slightly above the median of 3.71% expected by specialists1. Still, the annual inflation level remains within Banxico's target range (3% +/- 1%).

Productivity

On a positive note, labor productivity in the country closed 2024 at record highs; with particularly impressive figures in the service industry.

Overall, Mexico’s labor productivity index increased by 0.7% YoY, according to seasonally adjusted figures.

According to Banxico’s specialist survey.