Oracles

Which analysts are the best at predicting inflation?

Forecasting the future of economic variables has been a crucial topic for investment banks, research firms, and brokers since the dawn of time.

Now, with interest rates close to modern-time highs and the impacts of the pandemic still looming over inflation figures, having an accurate forecast for the CPI has become more important than ever.

Read by almost every researcher, trader, and economic analyst with exposure to the Mexican economy, the famous “Encuesta Citibanamex” collects inflation forecasts from experts each month to provide the market with an overall sentiment on where price increases might head in the near future.

However, to the best of our knowledge, we’ve never seen an in-depth analysis on the accuracy of these forecasts. How reliable are they? Which firm has had the most consistent results in the past few years? And how can we best use this valuable data to make important business decisions?

That’s why, for today’s Margin article, we’ve decided to do something a little bit different than usual and assess these questions.

We hope you find it useful.

Predicting where the market is going to move is, in itself, a very complex task. Economists and analysts, spend countless hours tuning and feeding their models with data to provide their clients and trading desks with the most accurate forecast.

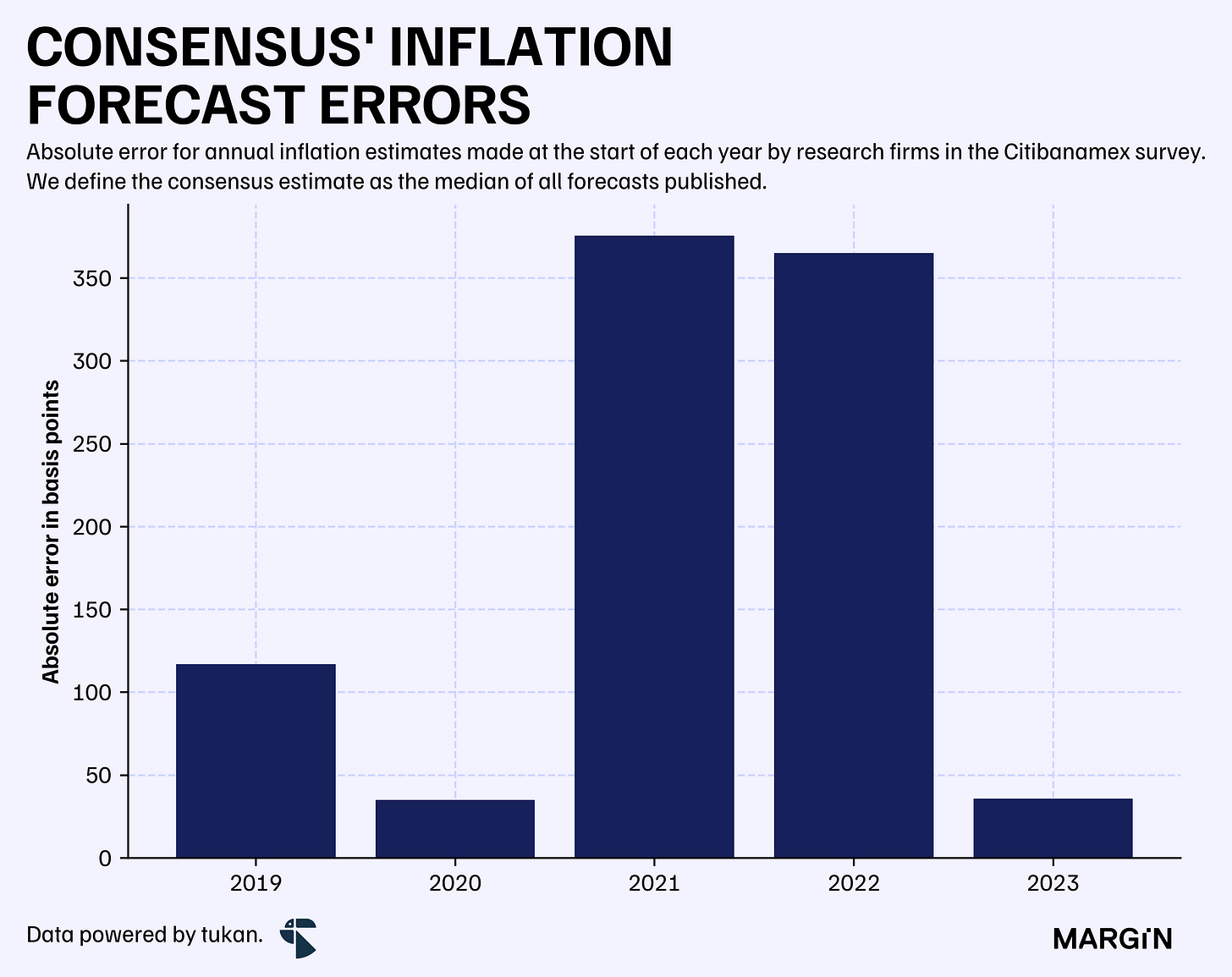

Since 2018, the consensus from research firms covering the Mexican economy has missed the observed inflation rate by about 185 basis points each year, on average.1

This figure is affected, of course, due to the much higher-than-expected inflation rates observed in 2021 and 2022. If we exclude those two years, the average error would be around 62 basis points (bps).

As expected, predictions made a year in advance consistently have higher error rates than those made closer to the forecast’s “target date” — especially in years with considerable volatility.

For example, by looking at predictions made between 2018 and 2023, we find that forecasts made 10 months (or more) prior to the official release of annual CPI figures had an average error of over 150 bps. As the end of the year approaches, the estimates become more accurate, with the average error decreasing to 55 bps for predictions made 6 months prior and 16 bps for those made 1 month prior to the official data release.

When excluding 2021 and 2022 from the sample, we see that the only major improvements in accuracy are 9 months and 1 month prior to INEGI’s press release.

Using 2022 as an example, we can observe how analysts' projections begin to adjust as the year progresses. However, this adjustment is sometimes not enough when there is too much uncertainty in the market.

Notice how at the start of December 2022—just a couple of weeks before INEGI published the country’s CPI figures—all analysts predicted that inflation would still surpass the 8% mark. Eventually, the rate closed the year at 7.8%.

Yes, you might think that a 20 bps error is close to perfect.

However, the stakes are extremely high for professional research teams. If you take a quick look at the previous chart, you can see that the average error for a 1-month forecast in a “normal year” was just about 11 bps.

Now that we've covered how the consensus performs, it’s time to take a look at individual analysts’ results.