SOFOMs, An Update

Revisiting Mexican non-regulated SOFOMs (ENR).

One year ago, we published a research piece on non-regulated SOFOMs, Mexico’s largest non-banking financial sector. This article became one of our most widely read pieces on Margin.

For today’s piece, we'll be revisiting this topic, providing updates on the sector’s composition and major players.

Whenever we refer to SOFOMs we’re exclusively talking about non-regulated entities or SOFOMes ENR.

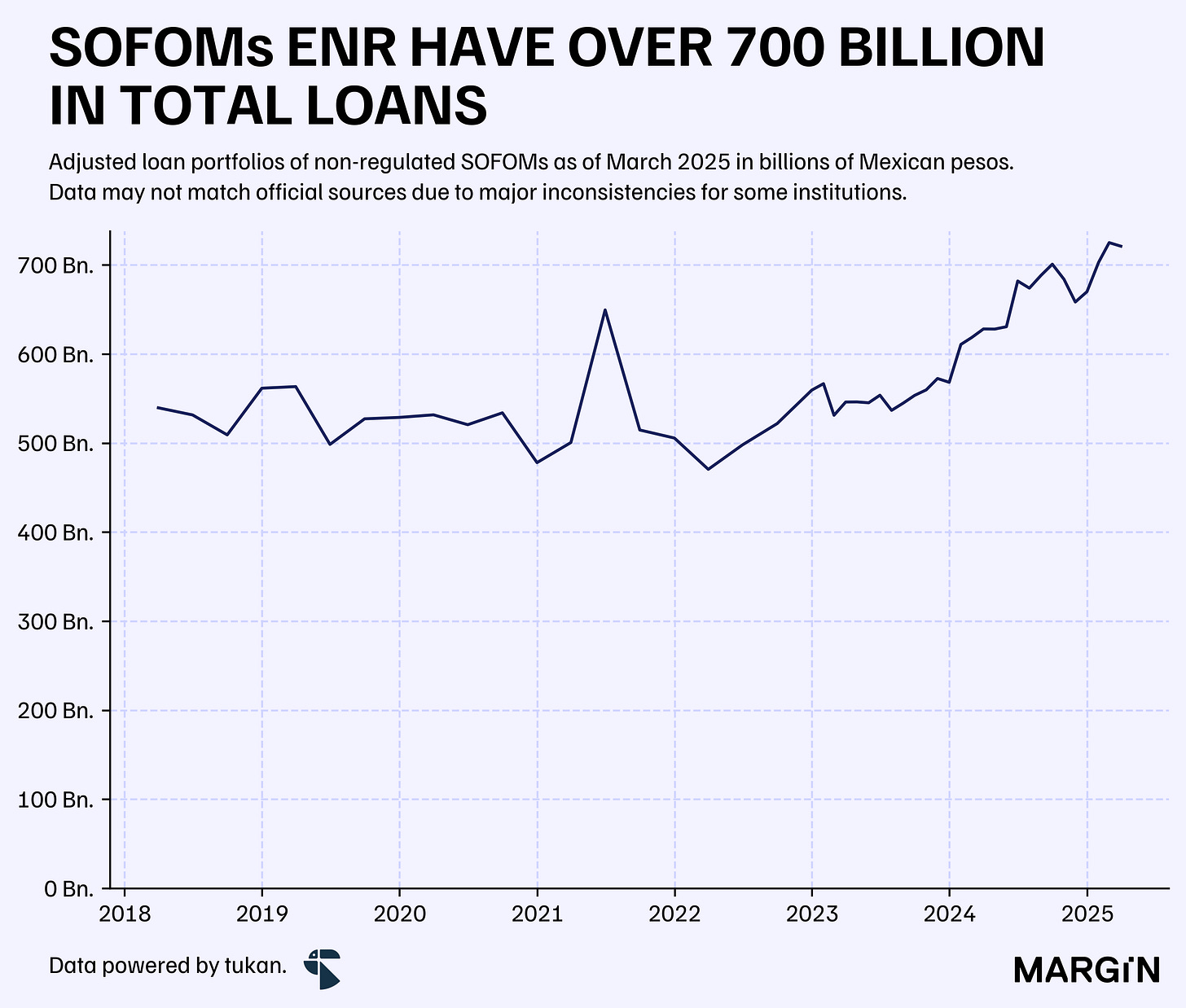

According to data from regulators, Mexican SOFOMs reported a loan portfolio of over $700 billion pesos at the end of 1Q25 — a figure 15% higher than at the end of March of 2024.1

We estimate that close to 1,680 companies were actively in operation at the end of March and close to 580 had loan portfolios exceeding $100 million pesos.

Based on the latest data, we estimate that over 80% of loan portfolio balances would be concentrated amongst the top 9.9% of players — a ratio 2.6 percentage points lower than in 2023 and 2.5 points higher than in 2018.

This would suggest a higher concentration amongst the industry’s largest players, with fewer companies having most of the loans in the market.

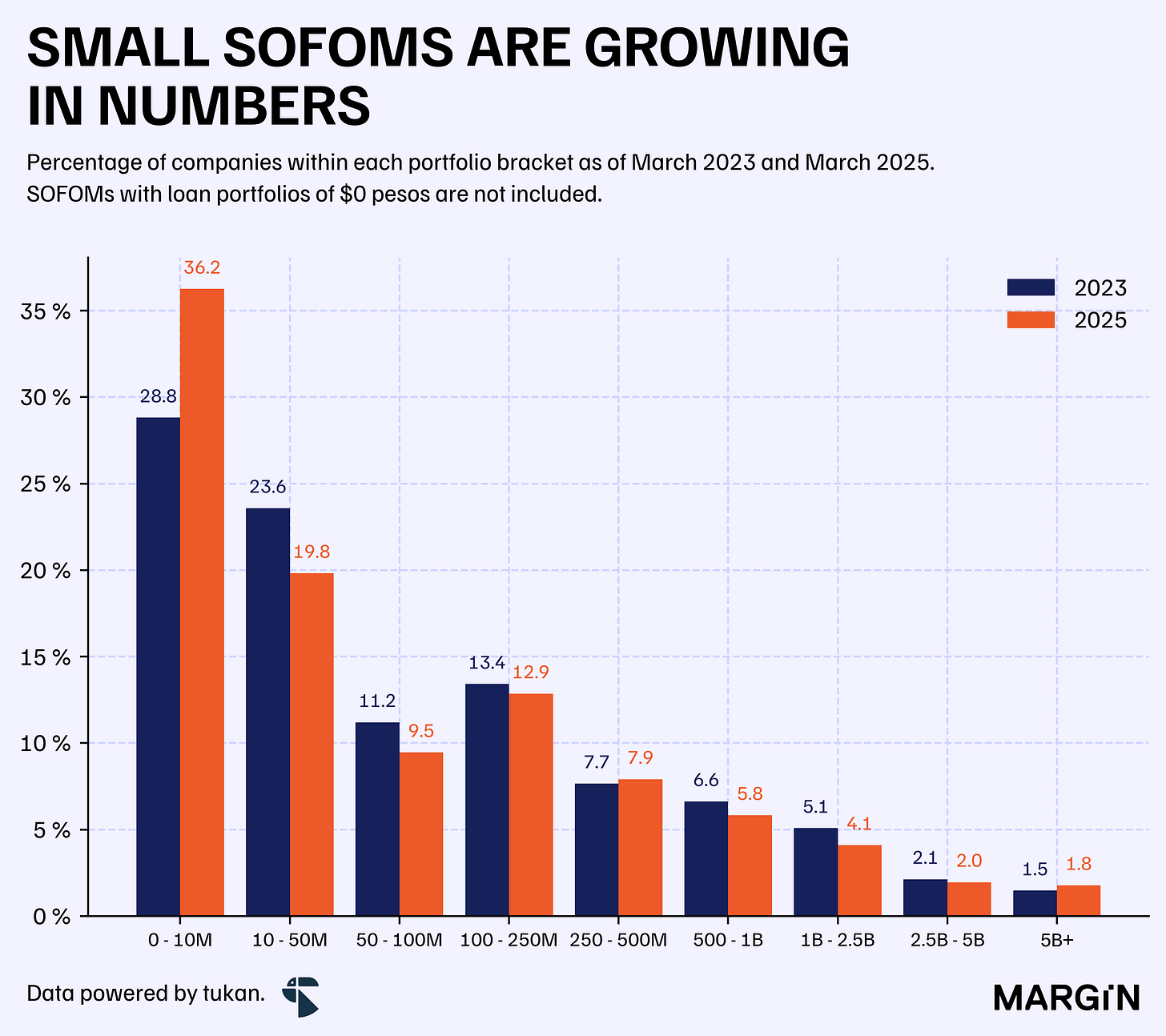

Furthermore, we are seeing close to 36% of all companies reporting loan balances below $10 million pesos at the end of 1Q25 — a share that increased by almost 8 percentage points when compared to 2023.

Interestingly, the only other two upward changes in the distribution were across very large SOFOMs (i.e. those with +$5 billion pesos in loans, +0.3 points) and across medium range companies ($250 - $500 million in loans, +0.2 points).

In terms of asset quality, 25% of non-regulated SOFOMs reported NPL ratios of over 15% at the end of March of this year — a figure 1 percentage points lower than the previous year; and one that’s been on a downward trend since reaching a record-high of 32% in 2021.