The Road Ahead

Analyzing the truck-freight landscape in Mexico and the companies that drive it forward.

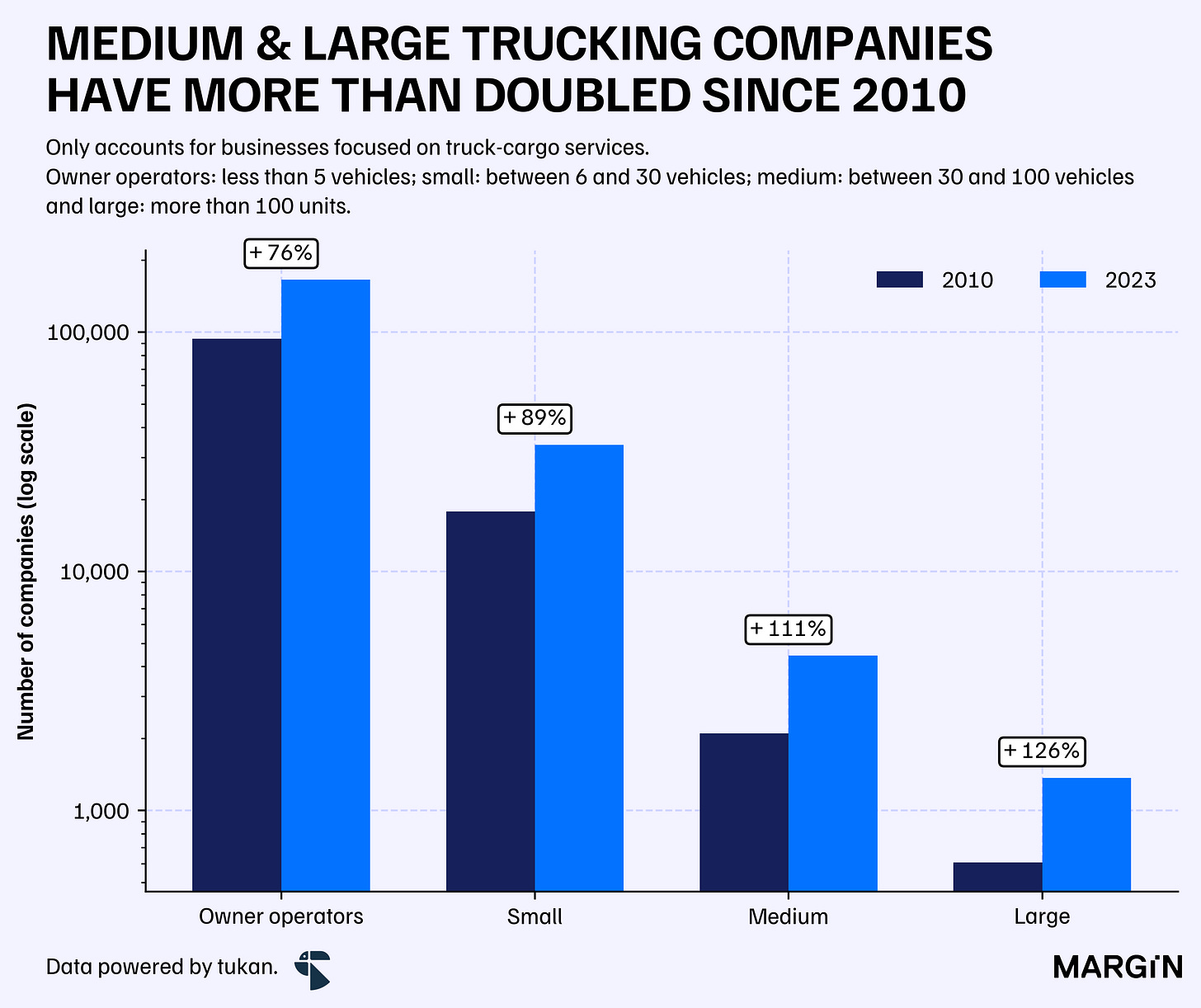

In 2010, there were close to 21,000 businesses providing freight-trucking services in Mexico.

Fast forward to 2023, and the number of businesses has grown by a staggering 85% to over 39,000 companies. The aggregate vehicle fleet now exceeds one million units—more than double the number reported in 2010—with 61% of the vehicles owned by over 5,000 medium and large companies (i.e., those with more than 30 vehicles in their operation).

It is worth noting that there are over 160,000 owner-operator businesses (i.e., those with fewer than 5 vehicles) operating within the country. In aggregate, these “single-truck operators” had a vehicle fleet of over 300,000 units at the end of 2023.

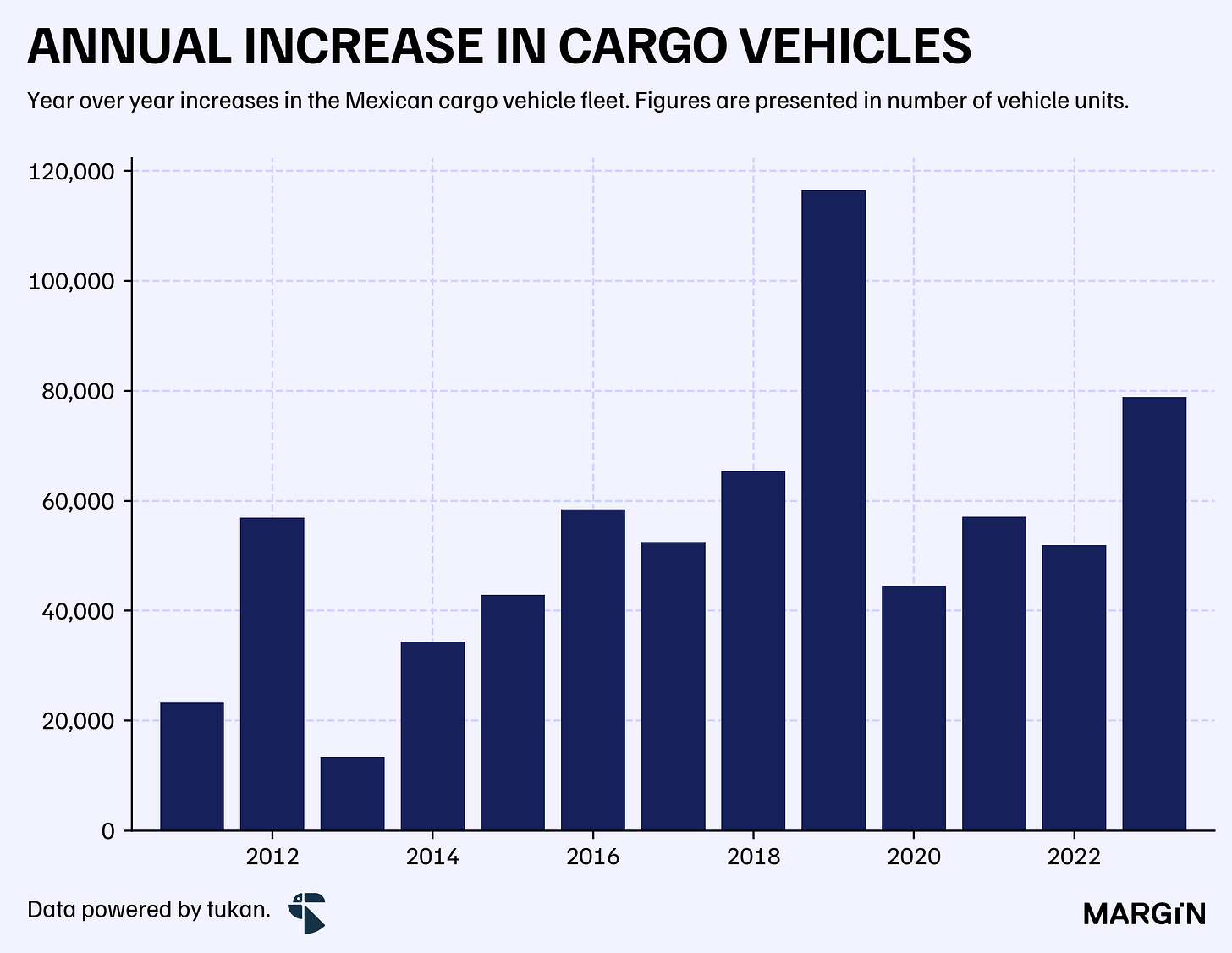

According to regulatory data, the cargo vehicle fleet in the country experienced most of its growth during 2019, the year in which the number of units first surpassed the one million mark. Despite some deceleration, growth has not stalled, with fleet figures expanding by 6% year-over-year in 2023—equating to almost 80,000 units added during the year, the second-highest increase in a span of 14 years.

It’s important to note that the cargo vehicle fleet is evenly distributed across two different types of vehicles: motor units (i.e., those with an engine, such as trucks and tractors) and towage units (such as trailers, semi-trailers, and the like).

In total, the number of motor and towage units closed 2023 at 670,000 and 660,000 vehicles, respectively.

In today’s Margin article, we analyze the truck-freight landscape in Mexico, exploring which business are acquiring the most vehicles in recent years, as well as giving some perspective on the industry’s growth as a whole.

Focusing solely on motor units, SCT data reveals that cargo operators registered over 23,000 brand-new vehicles in 2023, representing a 56% year-over-year increase. Furthermore, close to 12,000 new vehicles were registered during the first six months of 2024, setting a record for a first semester since the SCT began publishing data.

Over the past 12 months1, more than 3,200 companies have invested in at least one new motor vehicle for their operations. Among these, 400 companies registered over 10 units, and 29 companies acquired more than 100 units.

The following table lists the 29 companies that registered over 100 units between July 2023 and June 2024.