Monday, On the Margin

Trade; Banxico; inflation; airport operators; employment; industrial activity; Mexican stock exchange; heavy vehicles.

Trade

During the first 11 months of 2024, trade between Mexico and the United States totaled $776 billion USD, representing a 5.2% year-over-year (YoY) increase.

American imports of Mexican goods grew by 3.5%, pushing the trade balance between the two countries to a deficit of $157 billion USD (from Mexico’s perspective)—a 12% larger deficit compared to the same period in 2023.

According to the U.S. Census, Mexico’s share of U.S. imports stood at 15.4% in November, consistent with the figure reported the previous year. Excluding a dip in July 2024, this reflects the lowest annual import share increase since 2022.

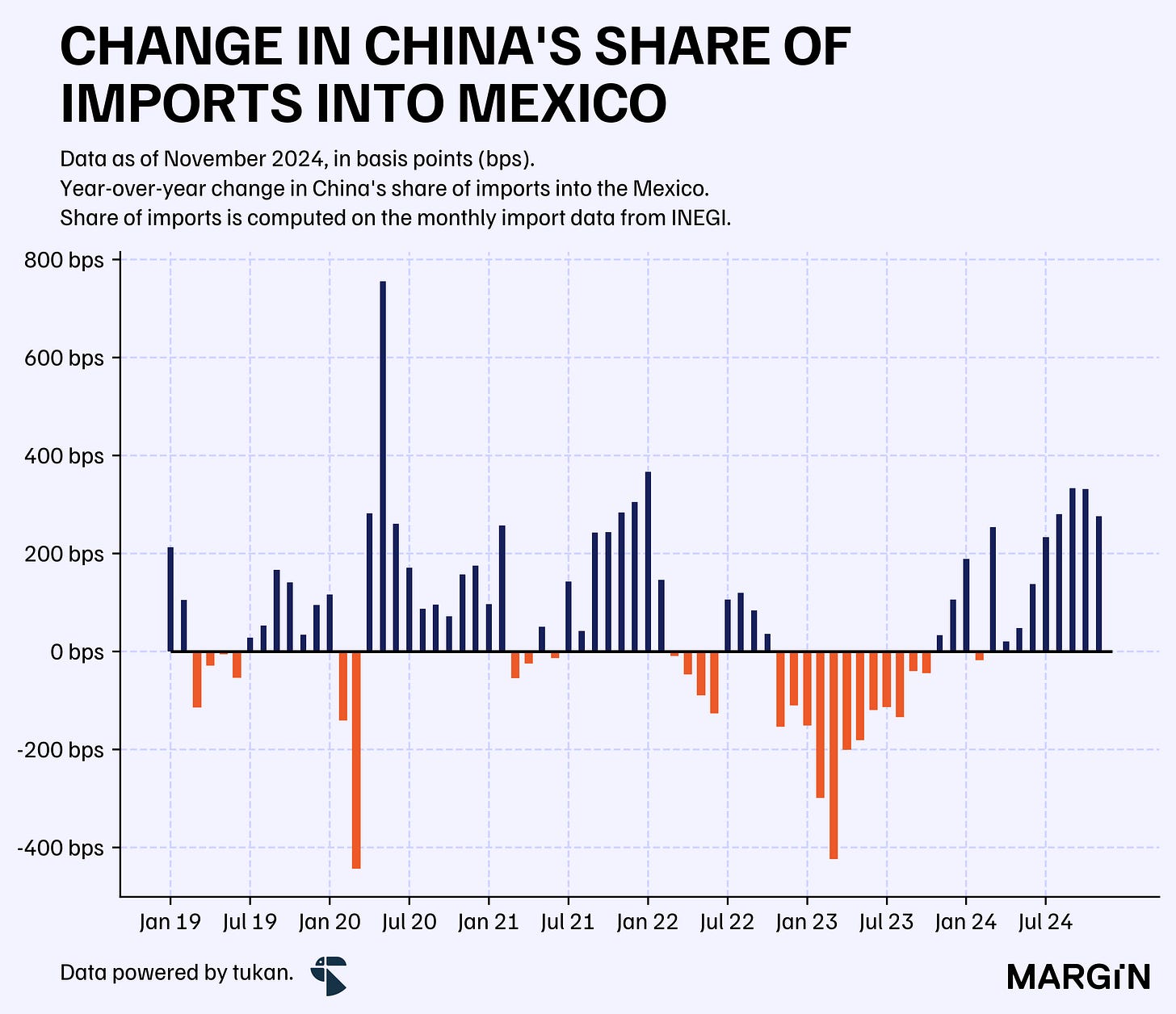

INEGI also released trade data last week, revealing that Mexico’s overall trade balance showed a deficit of $10.7 billion USD during the first 11 months of 2024, up 10.7% YoY. Notably, China's share of Mexican imports rose by 270 basis points, increasing the country’s exposure to Chinese imports to 22.3%.

Banxico

On December 19th, the Bank of Mexico's (Banxico) Board of Governors unanimously voted to lower the benchmark interest rate by 25 basis points, bringing it to 10%.

This marks the fourth consecutive 25 bps cut since August. In the memorandum released on Thursday, the following key points were highlighted:

Potential for Further Rate Cuts: If inflation trends remain favorable, the central bank may consider additional and potentially larger cuts to the benchmark rate.

Economic Growth Projections: Governors anticipate a slowdown in Mexico’s economic growth, driven primarily by external factors such as uncertainty in trade dynamics with the United States.

One of our key predictions for 2025 is that neobanks may reduce yields on demand deposits to levels below Banxico’s benchmark rate. We’ll be closely monitoring future monetary policy decisions for further developments.

Inflation

Mexican inflation closed 2024 at 4.21% year-over-year (YoY) and 0.38% month-over-month (MoM), signaling a continued deceleration in consumer price increases.

The non-core inflation index maintained its downward trend, rising by 5.95% in December, compared to consistent +6% increases over the prior seven months.

Airports

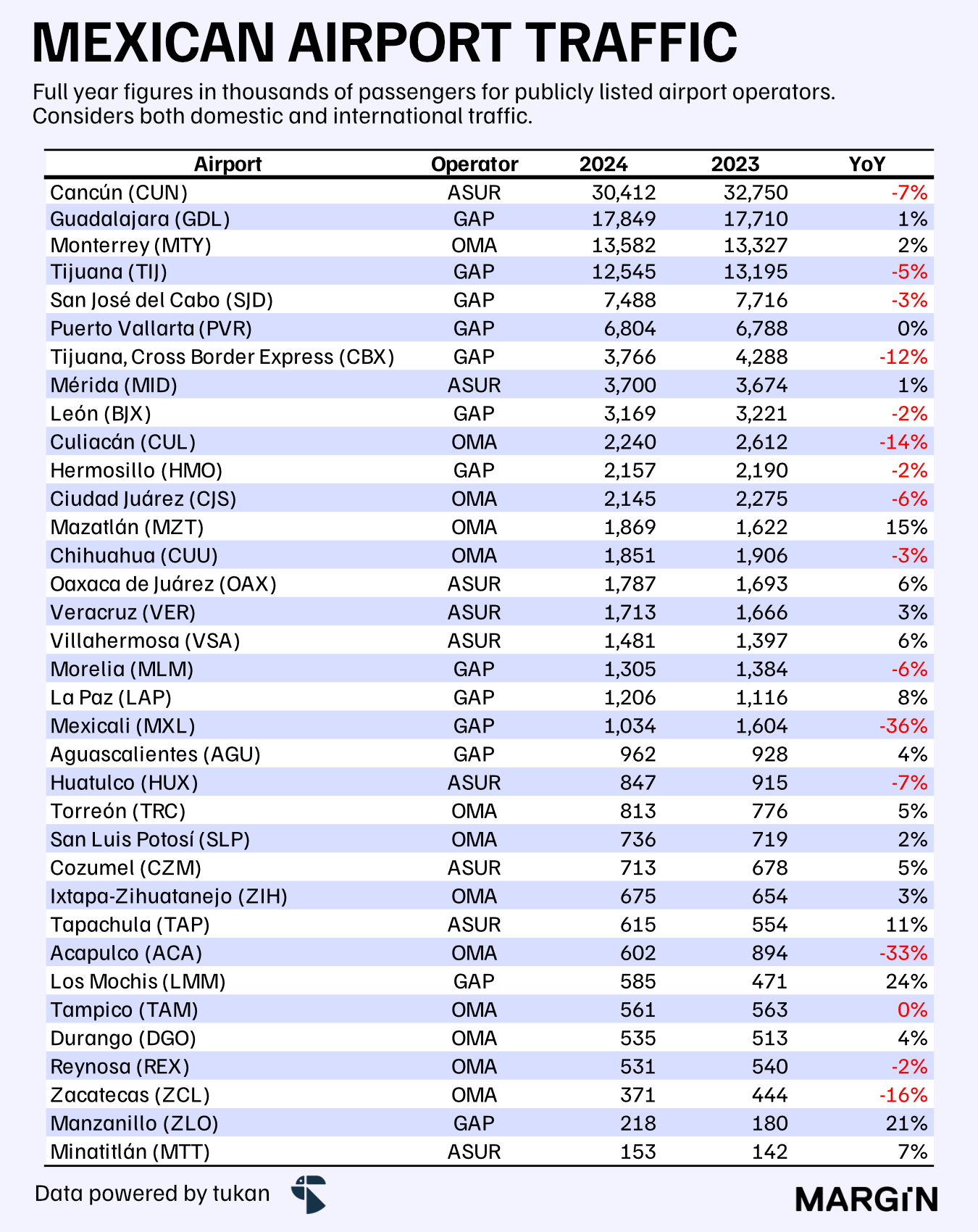

Air passenger traffic across Mexico’s three major airport groups (ASUR, OMA, and GAP) declined by 3.1% year-over-year (YoY) during 2024. This decrease was driven by a 5.2% drop in domestic traffic, partially offset by a slight 0.3% increase in international traffic.

In this analysis we’re excluding ASUR’s and GAP’s operations outside of Mexico.

ASUR experienced the largest decline, with passenger traffic falling 4.7% YoY, primarily due to significant drops in Cancún and Huatulco. Meanwhile, GAP and OMA saw modest increases in passenger flows at their major airports—Guadalajara and Monterrey, respectively. However, both groups reported notable contractions at some of their secondary operations.

Employment

Mexican Social Security (IMSS) reported 22.2 million registered workers at the end of December, reflecting a monthly decline of 1.8%.

While declines in IMSS data are typical for December, this contraction was the largest recorded for the month in the past 20 years. Additionally, the gross number of formal jobs created throughout the year ranked as the third-lowest since record-keeping began in 1998.

Industrial activity

Industrial activity showed signs of weakness toward the end of the fourth quarter of 2024, as the Industrial Activity Index (IMAI) remained flat MoM, but decreased by 0.9% YoY according to seasonally adjusted figures for the month of November.

This would be the third consecutive month of annual contractions for industrial activity in the country.

Utilities and manufacturing came in as the most resilient industries during the November report, +3.0% and +0.5% YoY, respectively.

Construction, on the other hand, showed the biggest drop of 4% YoY.

INEGI’s industrial activity index measures production output by industries, such as manufactured goods, energy generated, or minerals extracted.

Mexican Stock Exchange

Cash equities trading on the BMV increased by 4% year-over-year (YoY) in 2024, based on the total value traded during the year.

This growth was entirely driven by a 9% YoY increase in trading within the local market. However, it was partially offset by a 3% contraction in the value traded on the global market (or SIC).

Heavy vehicles

Heavy vehicle sales rose by 16.6% year-over-year (YoY) in 2024, with growth primarily driven by a 22.3% increase in wholesale transactions.

Hybrid vehicle sales reached 1,971 units, marking a significant 75% increase compared to 2023. Fully electric vehicle sales totaled 352 units for the year, reflecting a 19% YoY increase.

Market leaders Freightliner and Kenworth reported annual growth rates of 16.6% and 21.7%, respectively. Meanwhile, third-place International achieved a notable 51.3% YoY growth, selling 22,700 units.

From the archives

Next week we’ll start getting earnings releases from publicly listed companies.

In case you’re wondering how things came out at the end of the third quarter of last year, we recommend you revisit this article we published in November.

(Includes an Excel spreadsheet with Key Stats as of 3Q24).

Want more data?

Schedule a call with us to see if we can find the information you need for your business.