Predictions

Four predictions for what's in store during 2025.

These “forecasts” or predictions are made by the author purely for informational and entertainment purposes and do not constitute investment advice or reflect tukan’s official stance on any specific topic.

Let us know what you think in the comments!

1. Cargo

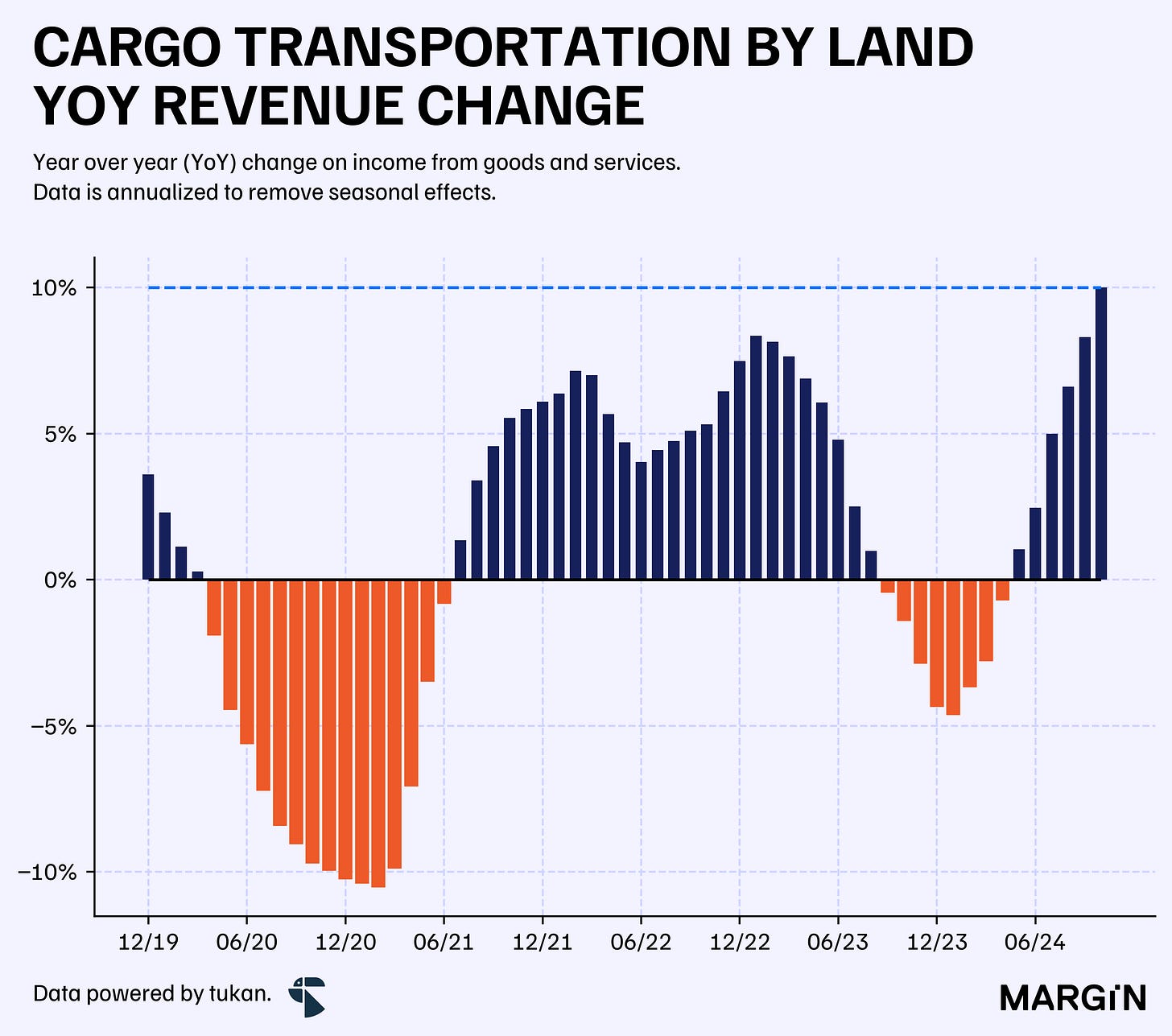

We believe that revenues for freight transportation companies in Mexico will achieve double digit growth in 2025.

Twenty years ago, freight transportation accounted for less than 3% of Mexico’s GDP. Since then, the industry has expanded at an impressive compound annual growth rate (CAGR) of 3% — a rate 1.4 percentage points higher than the national economy. This growth has boosted the industry’s share to over 3.8% as of 3Q24.

In an article we published earlier this year, we highlighted that the number of companies operating in the freight transportation sector has more than doubled since 2010. Plus, regulator data shows that since the second half of 2023, businesses in this space are making record-breaking investments in new vehicles, underscoring the sector’s optimism and confidence.

For instance, in the first 10 months of 2024, purchases of new motor vehicles by cargo transportation companies reached almost 19,000 units — a figure 5% lower than in 2023 (a record high for the country), but 57% higher than during the first 10 months of 2022.

Our forecast of double digit growth is mainly supported by:

A higher share of imports from Mexico into the United States. Currently, Mexico’s share within U.S. imports stands at 15.6% — 25 basis points higher than last year, and in some key industries, the share goes up to more than 25% (i.e. agriculture, transportation, beverages and tobacco).

The rapid rise of new entrants and vehicles into the market.

Impressive growth in financing opportunities for businesses in the space. The loan portfolio from banks towards this sector has been growing at 4-year CAGRs of +30% in 2024, making it one of the industries with the most expansion in recent years.

For context, since 2019, the industry has only seen (12-month rolling) double digit growth once: in October of this year.

2. Yield

We believe fintechs will considerably lower the rates offered on demand deposits. In particular, we think that most of them will end the year offering returns below Banxico’s reference rate.

So far this year, Nu, Klar, Finsus, and Stori have paid their users more than $8.4 billion MXN in interest for their deposits—as of October, this amounted to $170 pesos in interest (on average) per client during the month.

However, the loan portfolio for these companies isn’t nearly growing at the same pace. According to CNBV data, loan-to-deposit ratios (LDRs) for three of these four institutions stood between 27% and 30% at the end of October of this year.1

This implies that less than a third of deposits are being deployed into high-yield interest generating assets (i.e. loans) — for reference, commercial banks in Mexico have a loan to deposit ratio of 94%.

On an individual bank basis, LDRs closed October at 47% for BanCoppel, 67% for Banamex and 83% for Banco Azteca. BBVA, on the other end, had an LDR of 106%.2

Administrative and operating expenses are also expected to keep increasing as these four companies pursue an expensive banking license, adding further pressure on profitability.

A few weeks ago we published how margins on credit cards are a bit tighter than one might expect. We think that financial companies operating solely with a credit card product are likely to face a tough road towards profitability.

Despite many of them stating that they’re currently under an investment cycle and profitability is still not their top priority, we believe that spending another year offering their customers above-market returns is unsustainable and could also create “unrealistic expectations” for their deposit base.

Gradually lowering returns and taking them to the expected long-term spread they aim to offer seems a more sensible approach. In the end, we believe that they want people to sign up for the overall banking value proposition, not just because they offer above interbank interest rates.

We do expect that these new entrants will sustain above market average yields on demand deposits, just not above the central bank’s reference rate. In particular, we think that as Banxico begins its expected cut on interest rates, these institutions will follow suit with sharper declines that will eventually undercut the central bank’s reference rate.

3. Default

We see credit card non-performing loans plus write-offs (NPL adjusted ratio) rising considerably. Specifically, we expect them to surpass 16% of the total (credit card) loan portfolio — marking a 3 percentage point rise.

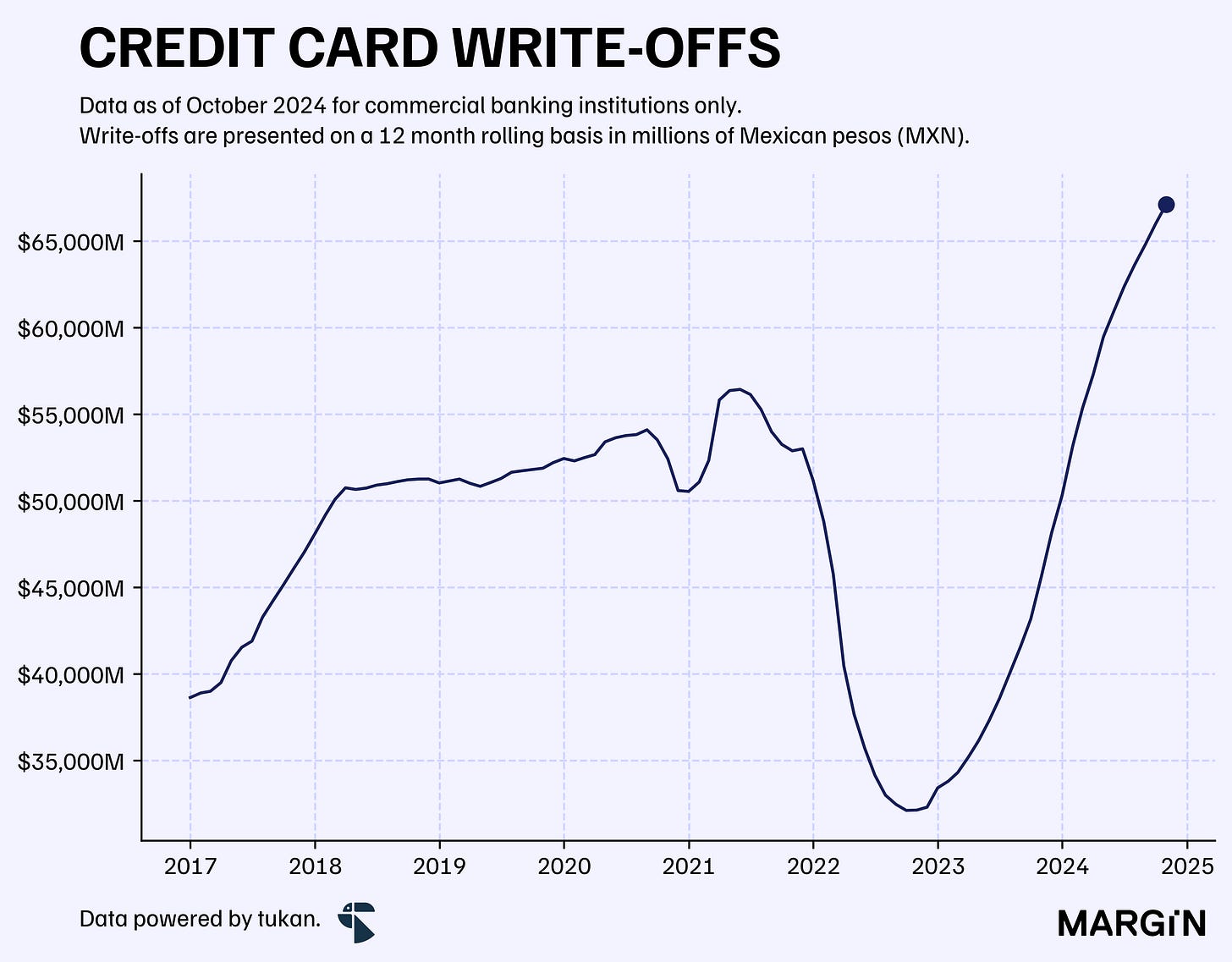

According to CNBV data, loan loss provisions related to credit card loans reached record level highs at the end of October of this year. Showcasing that banks are preparing for a considerable rise in delinquency for the product.

Cost of risk for credit cards has been rising at alarming levels since the drop observed after the effects from the pandemic, and we believe that under such a competitive environment, banks have become more prone to taking riskier bets within this product line.

Furthermore, credit card usage is rapidly rising with the number of annual transactions increasing at 4 year CAGRs of 20%, with many of these purchases now being “allocated” under installment schemes. Putting further pressure on Mexican’s household debt.

For context, at the end of August of 2017, close to 38% of total credit card balances were due to purchases under “meses sin intereses” promotions — a ratio that has now risen to more than 49% of the total balance.

During the first 10 months of 2024, write-offs from credit cards amounted to more than $65 billion pesos — 47% more than during the same period last year and 27% more than during 2021.

Although an NPL adjusted ratio of 16% is in-line with historical averages, it’s important to mention that IFRS9 changed the way that non-performing loans are classified for banks.

Non-performing loan balances on credit cards were greatly benefitted from IFRS9 accounting changes given that banks can now wait up until 90 days to classify a loan as non-performing. Prior to 2022, this period was of just 60 days.

Competition has greatly intensified within this space, which despite multiple benefits, we believe it has allowed Mexicans to take on more than one credit card to finance their everyday spending. As a consequence, we think that consumers may be borrowing a bit more than they can handle.

With banks willing to take higher risks within this product line, we find that this expected rise in delinquency could become a worrisome statistic for the industry.

4. Stalled

We think FDI into Mexico will stall amidst political uncertainty; something we expect to be reflected as an inflow of less than $35 billion USD during the year.

Supported by insights published in one of our most recent pieces, we think that political uncertainty in the country could cause FDI into Mexico to stall during 2025.

According to recent releases from the Mexican government, new investments as a share of total FDI has reached record lows. Plus, new investment announcements in recent quarters have come in at considerably lower levels than during 2023.

So far this year we’ve seen FDI come in at +$35 billion USD — marking a surge of 1.4% versus the previous year.

We think that next year we’ll see FDI contract when compared to 2024 and 2023, mainly as a consequence of a slowdown on fresh capital deployments from foreign companies, and even, a decrease on reinvested earnings.

We believe this “prediction” will hold unless we find some clarity early in the year of how a Sheinbaum - Trump relationship is expected to unfold that gives foreign and local operators confidence on the strategic partnership for both countries.

What to expect from Margin in 2025?

We’re really excited to continue giving our subscribers high-quality visual essays on companies and industries operating in Mexico.

We understand how difficult it is to find high-quality, accessible data-driven research on what’s happening in our country from an economic and financial perspective. Our goal is to provide you with weekly content that’s easy to read, has an important visual component, and leaves you learning something new.

Starting on the week of the 6th of January, you’ll now receive two weekly emails from us:

The standard weekly essay on a company, industry, or macro trend.

A weekly briefing (on Mondays) that summarizes the most important data points related to Mexico released during the previous week. This will be supported by the diverse data sources that we, at tukan, have been compiling and curating for over three years.

The goal with these new types of posts is to provide you with content that’s usually accessible only through stock broker research services, condensed into a curated email.

We hope you enjoy it and that it adds value to your weekly reading lists. As always, we welcome all feedback and suggestions as we continue to build this newsletter for our readers.

Please shoot me an email at: miguel@tukanmx.com if you’d like to learn more about our plans.

Happy new year!

Stori had a loan to deposit ratio of 4x, mainly because of the company’s relatively recent entrance into the market.

This only considers the sum of term and demand deposits. Not overall funding.