Monday, On the Margin

IGAE; funding costs; mortgages; IMMEX; inflation; construction; trade and services.

IGAE

Last week, we received some important data points for 2024, with economic activity in Mexico poised to end the year with modest growth.

In November, the IGAE—a short-term index by INEGI that provides an early indicator of economic growth—rose by just 0.9% year-over-year (YoY), reflecting a significant deceleration compared to previous months.

The index’s sluggish performance was largely driven by a modest 0.5% increase in the manufacturing sector, which was only slightly offset by gains in service sectors.

According to the IGAE, four industries reached 10-year highs in production output: retail trade, health care, real estate services, and transportation and warehousing.

Others, such as: education, financial services, manufacturing and professional and technical services, reached their 10-year highs at some point during 2024.1

Looking ahead, INEGI’s IOAE index, which is an early estimate for the IGAE index points to a 0.6% YoY growth for the Mexican economy during the 4th quarter of 2024.

Funding costs

Funding costs for commercial banks in local currency closed 2024 at 5.40%, a rate 30 basis points (bps) lower than the previous year.

The spread between Banxico’s benchmark rate and banking funding costs peaked during the early months of 2023. Since then, banks have been gradually narrowing the spread2, closing the year with a difference of just 4.75 points—the lowest level in the past two years.

According to central bank data, most banks with the largest share of public deposits reduced their spreads against the reference rate by 40 to 120 bps YoY. This represents one of the sharpest declines in recent years, second only to the shifts observed during 2020.

Mortgages

The mortgage loan portfolios of commercial banks surpassed $1.4 trillion pesos by the end of November 2024, reflecting a 7.9% year-over-year (YoY) increase.

November’s growth rate marked the slowest expansion in the housing loan portfolio since 2011.

According to CNBV data, banks and regulated SOFOMs granted just over 90,000 mortgage loans (-4.5% YoY) for the acquisition of new and used housing during the first 11 months of the year. This is the lowest figure recorded since the regulator began publishing detailed data on this segment in 2019.

IMMEX

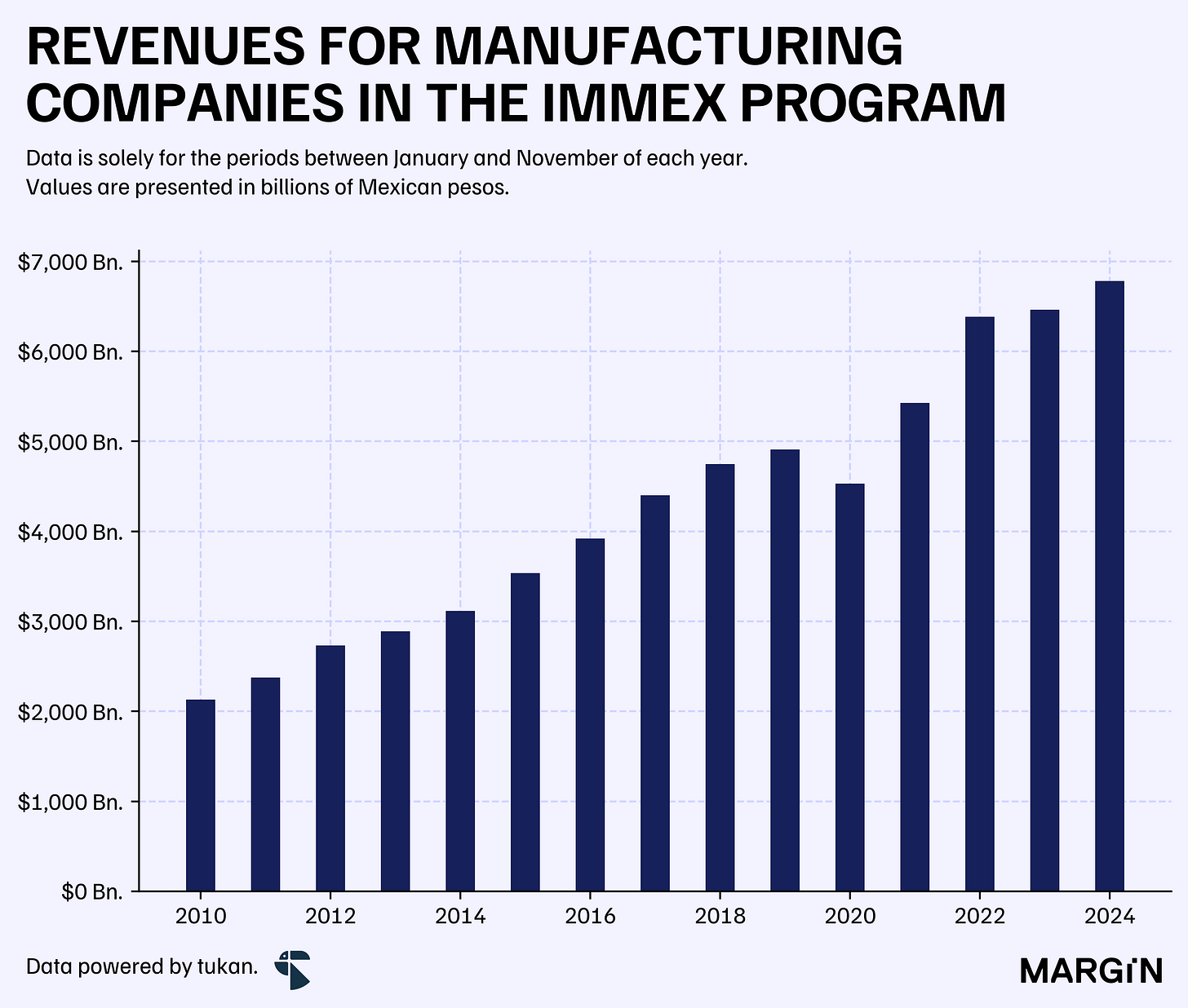

According to INEGI, manufacturing companies participating in the IMMEX program reported a 4.9% (YoY) revenue increase, totaling nearly $6.7 trillion pesos between January and November 2024—a historical high for an 11-month period.

As of November 2024, there were 5,200 active manufacturing companies in the program, with average total revenues of $1.3 billion pesos per company during the first 11 months of the year.

The IMMEX program is designed for companies involved in producing goods or providing services for export markets. This includes manufacturing, assembly, and logistics operations, which are commonly associated with maquiladora (assembly plant) activities.

The program enables participating companies to temporarily import goods, raw materials, components, machinery, and equipment needed for the production of export goods without incurring certain taxes and duties.

The development of IMMEX 4.0 is a key part of Sheinbaum’s Plan México, with a particular focus on boosting the semiconductor industry.

Inflation

Prices rose by 0.38% in December 2024, bringing the annual inflation rate to 4.21%, a rate slightly below expectations.3

Core inflation, which tracks non-volatile goods and services, increased by 3.65% — pointing to positive signs of a deceleration in overall prices. However, non-core inflation continues in its upward trend, rising by more than 5.95% YoY.

On a recent article, we explored how inflation hits the most at the bottom of the income bracket.

Construction

Overall production value for construction companies dropped by 22% YoY during November; making it the 6th consecutive month of annual contractions for the industry according to the monthly survey conducted by INEGI.

The entirety of the decline came from construction projects overseen by the public sector; whereas projects from the private sector increased by 2.5% YoY — only slightly offsetting the major decline from publicly funded projects.

Housing construction from the private sector continues to struggle, with production value decreasing by more than 9% YoY. However, industrial and commercial building projects continue boasting double digit growth for developers.

Trade

Wholesale and retail trade companies in Mexico reported annual declines of 5.0% and 1.9%, respectively, in price-adjusted revenues during November. This marks the 12th consecutive decline for wholesale trade revenues and the 7th for retail trade.

On a brighter note, retail trade revenues remain near record highs on a 12-month rolling basis, with the recent contraction driven primarily by a high comparable base.

Services

On the other hand, businesses in the services sector continue to report robust growth figures.

Revenues for non-financial services rose by 4.5% year-over-year (YoY) in November, based on price- and seasonally-adjusted data, building on the industry’s consistent recovery trajectory since 2022.

It’s important to mention that despite some solid growth in recent years, the revenue index for non-financial services in Mexico continues slightly below pre-pandemic levels.

Standout performances were seen in sectors such as transportation, professional services, healthcare, and real estate, all of which reported double-digit revenue increases compared to the previous year.

Want more data?

tukan can help you find the information you need for your business. We specialize in extracting data from public sources and web-scraping projects to help you address strategic business decisions.

Schedule a call with us to see how we can help.

Based on seasonally adjusted figures.

The difference between Banxico’s reference rate and the bank’s funding cost.

According to Banxico’s specialist survey.